Award-winning PDF software

How to prepare VA 21-0781

About VA 21-0781

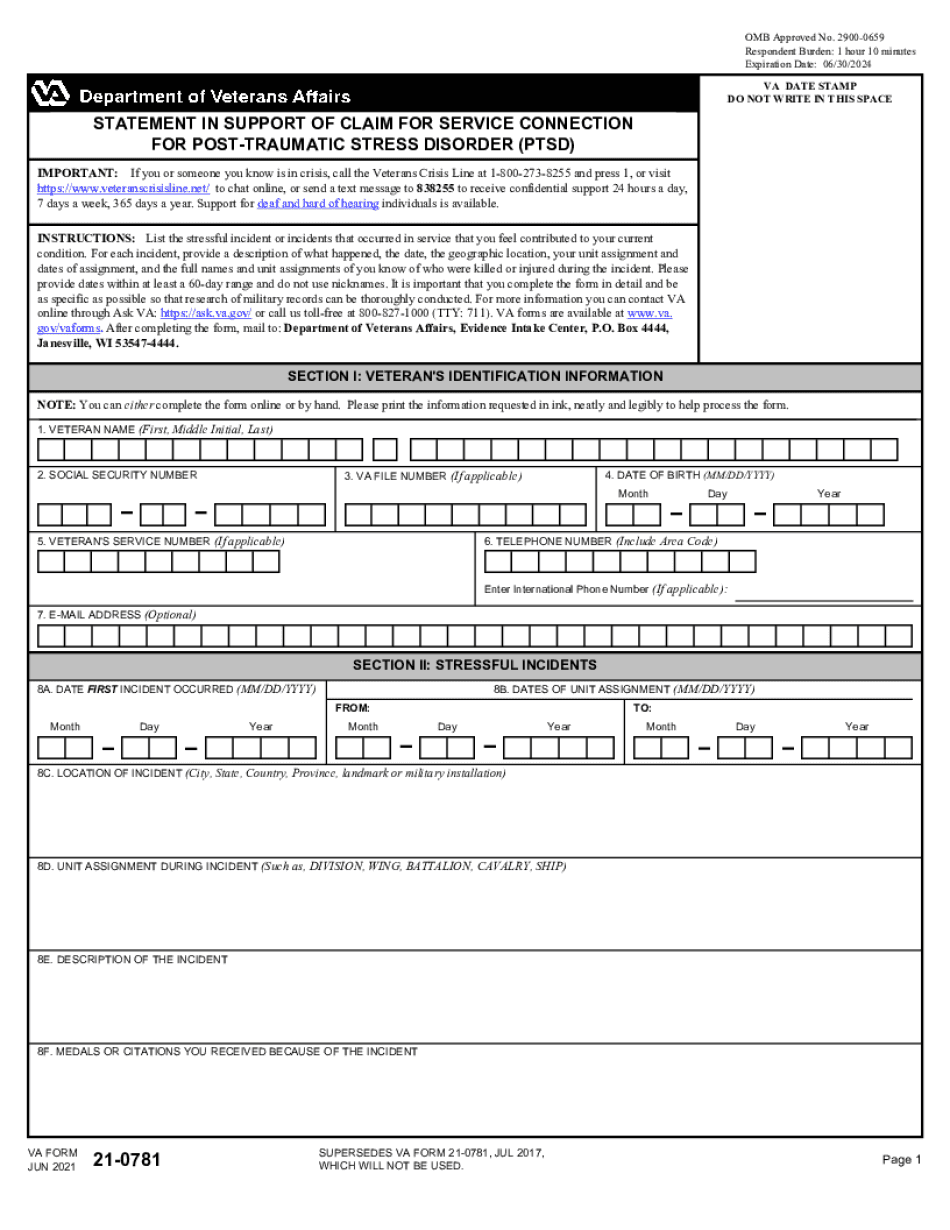

VA Form 21-0781, also known as the "Statement in Support of Claim for Service Connection for PTSD" is a form used by the Department of Veterans Affairs (VA) in the United States. This form is designed to assist veterans in providing information related to their claim for service connection for Post-Traumatic Stress Disorder (PTSD). Veterans who are seeking to establish service connection for PTSD must complete this form and provide details regarding their traumatic experiences during military service, the resulting symptoms they are currently experiencing, and how these symptoms impact their daily life. It allows veterans to provide a comprehensive account of their traumatic experiences and the subsequent effects on their mental health. Any military veteran who believes they have developed PTSD as a result of their military service may need to fill out VA Form 21-0781. This form is essential for veterans applying for disability benefits or compensation related to PTSD from the VA. It helps veterans articulate their experiences and symptoms, providing documentation to support their claim for service connection. It is important for veterans to consult with the VA or a veterans' service organization for guidance on completing VA Form 21-0781, as proper completion and submission can significantly impact the success of their claim for service connection for PTSD.

Online solutions make it easier to arrange your file management and raise the productivity of your workflow. Follow the brief manual in order to fill out VA 21-0781, avoid errors and furnish it in a timely way:

How to fill out a VA form 21 781 ptsd?

-

On the website hosting the blank, press Start Now and go for the editor.

-

Use the clues to complete the relevant fields.

-

Include your personal data and contact data.

-

Make absolutely sure that you enter correct details and numbers in appropriate fields.

-

Carefully examine the information of the document as well as grammar and spelling.

-

Refer to Help section should you have any questions or contact our Support team.

-

Put an digital signature on the VA 21-0781 printable using the support of Sign Tool.

-

Once blank is completed, click Done.

-

Distribute the ready form by way of electronic mail or fax, print it out or download on your gadget.

PDF editor enables you to make modifications on your VA 21-0781 Fill Online from any internet connected gadget, personalize it in line with your requirements, sign it electronically and distribute in different ways.